XRP Price Prediction: Assessing the Path to $3 Amid Technical and Fundamental Crosscurrents

#XRP

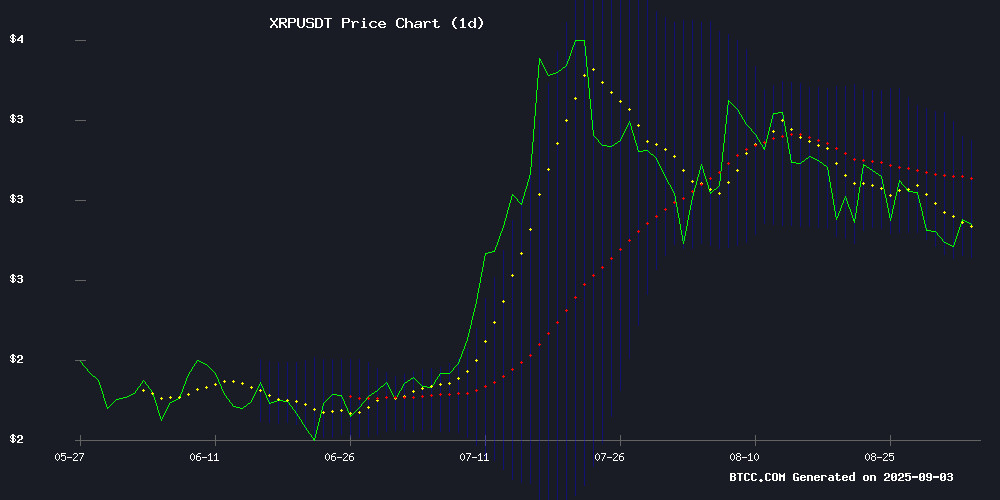

- Technical indicators show XRP consolidating below key resistance at $2.94 with Bollinger Bands suggesting a trading range between $2.72-$3.17

- Mixed fundamental landscape with positive developments (CBDC recognition, ETF prospects) offset by challenges ($1B unlock, competitive pressures)

- The path to $3 requires breaking above the 20-day MA and maintaining momentum despite potential selling pressure and market volatility

XRP Price Prediction

Technical Analysis: XRP Approaches Key Resistance Level

XRP is currently trading at $2.84, showing signs of consolidation below the 20-day moving average of $2.94. The MACD indicator reveals a slight bearish crossover with the MACD line at 0.1161 below the signal line at 0.1254, though the histogram remains relatively flat at -0.0093, suggesting weakening downward momentum. The price sits comfortably within the Bollinger Band range of $2.72 to $3.17, with the middle band at $2.94 acting as immediate resistance. According to BTCC financial analyst John, 'XRP needs to break above the $2.94 level to challenge the upper Bollinger Band at $3.17, which WOULD open the path toward the $3 psychological barrier.'

Mixed Sentiment Amid Fundamental Developments

Market sentiment for XRP appears cautiously optimistic despite several fundamental challenges. Positive developments include JP Morgan's recognition of XRP as a CBDC heavyweight, new credit card integration prospects, and potential ETF considerations. However, these are balanced against concerns surrounding Ripple's $1 billion XRP unlock, alleged Binance sell-off pressures, and emerging competition from projects like Remittix in the payment sector. BTCC financial analyst John notes, 'While technicals show consolidation, the fundamental landscape presents both tailwinds and headwinds that could influence XRP's ability to sustain momentum toward higher price levels.'

Factors Influencing XRP's Price

XRP Flashes Key Bullish Signal Amid Rebound Setup

XRP is showing signs of a potential rally as it tests the $2.70 support level for the third time in six weeks. The repeated defense of this zone has drawn attention from traders, given its historical significance.

Crypto expert Ali Martinez highlighted a bullish TD Sequential signal, suggesting a rebound may be underway. XRP's breakout above $2.825 could trigger a 10% surge, with the asset already up 1.35% to $2.80 at press time.

Trading volume has increased 11% over the past 24 hours, reflecting growing market participation. Technical indicators point to a reversal of the recent downtrend, though EMAs on the 15-day and 21-day charts remain key hurdles.

Ripple Grapples with $1B XRP Unlock, Binance Sell-Off Allegations, and SWIFT Criticism

Ripple's XRP faces a trifecta of challenges as it navigates its scheduled $1 billion token unlock, alleged coordinated selling on Binance, and public criticism from SWIFT leadership. The monthly escrow release—this time involving 200 million XRP ($553 million)—coincides with heightened market scrutiny and potential exchange manipulation concerns.

Whale Alert's disclosure of the escrow unlock has amplified existing bearish sentiment. Programmatic supply increases historically correlate with price volatility, particularly when paired with unusual trading activity. Binance's order books now show anomalous sell pressure that traders suspect may be artificially depressing XRP's value.

SWIFT's recent remarks attacking distributed ledger technology add regulatory uncertainty to the mix. Market participants are monitoring whether these concurrent events will trigger cascading liquidations or present accumulation opportunities for long-term holders.

XRP Price Volatility and Remittix's Emerging Challenge in the PayFi Sector

XRP's price dipped 4% to $2.75 amid $1.9 billion in institutional liquidations since July, yet whale accumulation of 340 million tokens signals underlying confidence. Technical indicators present a mixed picture: RSI nears oversold territory at mid-40s, while MACD maintains bearish divergence—though sustained whale buying could shift momentum. Key support lies at $2.75-$2.77, with resistance at $2.87; a breakout could target $3.30 or higher liquidity zones.

Meanwhile, Remittix gains traction as a structured alternative to XRP's volatility, with its PayFi ecosystem attracting investors seeking real-world utility. The project's roadmap suggests potential to rival Ripple's dominance in cross-border payments by 2027, particularly as market participants diversify beyond established players.

XRP Price Faces Continued Bearish Pressure in September

XRP remains trapped in a descending parallel channel, signaling persistent bearish dominance. The altcoin has repeatedly failed to break above this structure since August 2, with each attempt met by aggressive selling pressure. Lower highs and lower lows continue to define the price action, reflecting dwindling buy-side interest.

Exchange reserves tell a concerning story—Glassnode data shows a 2% increase in XRP holdings on trading platforms since August 27. This accumulation suggests growing distribution pressure as holders MOVE tokens to exchanges, likely preparing for further sell-offs. Market sentiment remains decidedly negative, creating headwinds for any sustainable recovery.

The technical setup mirrors fundamental weakness. Without a catalyst to shift the supply-demand balance, XRP appears vulnerable to extended downside. Traders should watch for breakdowns below channel support, which could accelerate losses in September.

XRP Holders Turn to Blockchain CloudMining for Stability Amid Market Volatility

As cryptocurrency markets churn with uncertainty, XRP holders are increasingly turning to cloud mining as a hedge against volatility. Blockchain CloudMining has emerged as a key platform, utilizing XRP as its primary settlement currency to offer passive income opportunities without the hardware burdens of traditional mining operations.

The platform leverages XRP's established payment network advantages—notably its rapid transaction speeds and minimal fees—to create a seamless mining experience. This comes at a time when inflationary pressures on fiat currencies are driving more investors toward crypto-based yield strategies.

Security remains a cornerstone of the offering, with Blockchain CloudMining emphasizing renewable energy use and regulatory compliance. The model demonstrates how legacy crypto assets like XRP are finding new utility beyond payments in decentralized finance ecosystems.

Ripple (XRP) Gains Momentum with New Credit Card and ETF Prospects

Ripple's XRP token showcased significant developments this week, highlighted by Gemini's launch of a credit card offering XRP rewards. The card also supports Ripple's stablecoin RLUSD, enhancing utility for US spot trading on Gemini's platform.

Institutional interest in XRP grows as an Illinois-based investment firm files for an Options Income Fund focused on XRP derivatives. While not a traditional spot ETF, the fund aims to generate monthly yields through options strategies. Market sentiment remains bullish, with Polymarket indicating an 87% probability of a spot XRP ETF approval by year-end.

The XRP Ledger continues its upward trajectory, surpassing $130 million in real-world asset market capitalization by Q2 2025. Network activity and adoption metrics reinforce Ripple's position as a leader in blockchain-based financial solutions.

XRP Investors Weigh Options Amid Hypothetical $500 Price Scenario

Ripple's XRP emerges as a focal point in crypto markets following its legal clarity with the SEC. Analyst Kenny Nguyen's hypothetical $500 price scenario sparks debate among holders about strategic responses—whether to sell, accumulate, stake, or even taunt regulators.

The token's resilience through regulatory battles and expanding global partnerships contrasts sharply with its previous suppressed valuation. Market participants now evaluate XRP's product pipeline against its renewed trading freedom, creating divergent views on optimal positioning.

Nguyen's poll frames the psychological crossroads for retail investors: profit-taking at unprecedented levels versus doubling down on what some consider overdue valuation recognition. The inclusion of "call Gary Gensler" as an option underscores lingering industry resentment toward regulatory obstruction.

Ripple Forms Spinning Bottom Pattern: What Does it Mean for XRP’s Price?

XRP has formed a spinning bottom candlestick pattern, signaling a potential bullish reversal after weeks of decline. The asset plummeted over 20% since mid-July, but the recent pattern suggests bears may be losing steam.

Spinning bottoms occur when prices swing widely but close NEAR opening levels, indicating a stalemate between bulls and bears. When this appears after a steep drop near key support, it often precedes a reversal. XRP’s plunge from $3.65 to $2.70 aligns with this setup, though confirmation requires a green candle closing above the pattern’s high.

Ripple’s community closely watches XRP’s price action, fueling both measured forecasts and extreme predictions. Technicals now hint at a possible turnaround, but market participants await decisive momentum.

JP Morgan Recognizes XRP as CBDC Heavyweight Amid Exchange Reserve Surge

JP Morgan has designated Ripple's XRP as a "heavyweight in the age of CBDCs," coinciding with a 797% spike in exchange reserves within one hour. Bitpanda's XRP holdings surged from 156,323 to 717,208 tokens, reflecting heightened trading demand rather than operational adjustments.

The European exchange flagged XRP as "highly-sensitive" to regulatory developments, while market data shows altcoins gaining strength against Bitcoin. "This isn't just liquidity management—it's organic interest materializing on-chain," noted Bitpanda deputy CEO Lukas Enzersdorfer-Konrad.

Analysts are recalibrating price models following JP Morgan's institutional endorsement at the Money20/20 conference, viewing XRP's infrastructure as increasingly pivotal for cross-border settlements in the digital currency era.

XRP Price Climbs Amid Surging Trading Volume

Ripple's XRP gained 2.01% to trade at $2.80 as 24-hour trading volume spiked 37.75% to nearly $6.92 billion. The rally reflects sustained market interest, with the token's weekly performance now up 3.66% and market capitalization reaching $166.53 billion.

MemeCore, Four, and Pump.fun led today's gainers while OFFICIAL TRUMP, PYTH Network, and Bonk underperformed. The volume surge suggests accumulating investor positions anticipating near-term upside.

XRP Price Recovery in Focus – Can It Overcome Selling Pressure?

XRP price is attempting a recovery from the $2.70 support level, with potential upside momentum if it breaches the $2.850 resistance. The cryptocurrency recently tested a low of $2.7018 after declining below key levels, including the 100-hourly Simple Moving Average.

A bearish trend line near $2.820 on the hourly chart poses immediate resistance. Market participants are watching whether bulls can defend the $2.750 support zone, which could pave the way for another upward attempt. Clearing $2.850 WOULD signal stronger recovery prospects.

Will XRP Price Hit 3?

Based on current technical indicators and market sentiment, XRP faces both opportunities and challenges in reaching $3. The price currently trades at $2.84, requiring approximately a 5.6% increase to reach the $3 threshold. Key resistance levels include the 20-day MA at $2.94 and the upper Bollinger Band at $3.17.

| Indicator | Current Value | Significance for $3 Target |

|---|---|---|

| Current Price | $2.84 | 5.6% away from target |

| 20-Day MA | $2.94 | Immediate resistance level |

| Upper Bollinger Band | $3.17 | Secondary resistance above $3 |

| MACD Signal | Bearish crossover | Suggests near-term consolidation |

BTCC financial analyst John comments: 'While the $3 level is within technical reach, XRP must overcome selling pressure from recent unlocks and maintain positive momentum from developments like CBDC recognition and ETF prospects. The next few trading sessions around the $2.94 level will be critical for determining whether a push toward $3 is feasible in the near term.'